Discounting costs and revenues is standard practice in strategic forest planning models to account for productivity of capital over time and to hedge against risk. The rate at which we want these forest management models to discount future cashflows can have a big effect on optimal harvest schedules.

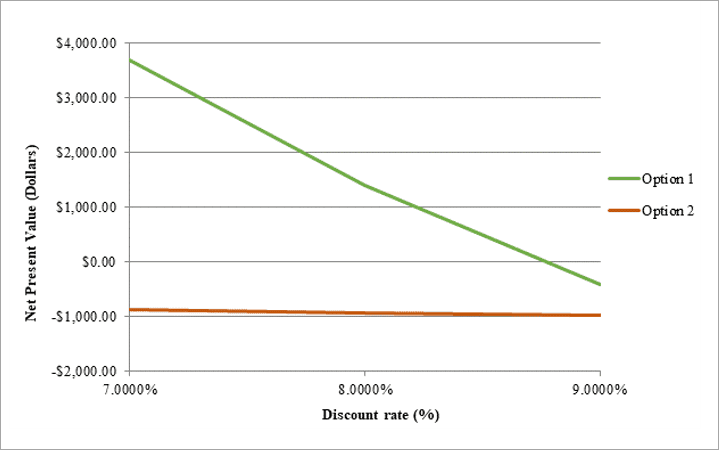

A central assumption inherent in discounting is the rate used. Changing the discount rate in any given model can lead to very different model behavior and can drastically change the timing of management activities as well as the net present value.

In order to make a wise decision about what discount rate to use it is important to understand what causes these changes.

What is a Discount Rate?

Applying a discount rate compares the return of a particular activity (planting, harvesting, thinning), a series of activities, or a forest management plan to an alternative investment with a known return (expressed as a percentage). The rate of this return, also known as the alternate rate of return (ARR), is often used as the discount rate if the two investments are similar in terms of risk, liquidity and other factors.

Net present value (NPV) indicates the net return (or loss) of that particular activity compared to the alternative investment. Each dollar invested in an activity must return at a rate greater than the discount rate to have a positive NPV and to make an investment financially viable. The greater the NPV, the greater the return is expected to be relative to that of the alternative.

Investments that are to be made several years from now need to account for potential returns up to that time because those funds could be invested in the alternative today.

The discount rate used should reflect the ability of the landowner or beneficiary to pursue alternative investment options for profit or to access credit to finance the activity in question. It could be the cost of capital for example, or the rate that an alternative investment will generate.

Why is the Discount Rate Important?

Forests stands are often managed to an age which maximizes their economic return. This is referred to as the economic rotation age or age of financial maturity. This age depends on the growth rate of the forest and the value of harvest at any given age. After a certain age, the annual growth increment slows enough that it is better to harvest and start a new rotation than to continue growing the stand.

The discount rate is important because it will directly impact the economic rotation age of the forest. Higher discount rates require rotation ages to be shorter as each year of growth also means a larger return to overcome. It also means that investments such as planting may be less common further out in the planning horizon as future returns will be discounted at higher rates.

Higher discount rates will lead to shorter rotations, more volume harvested earlier in the planning horizon and less management activity later in the horizon. The model will try to capture as much revenue as possible early in the planning horizon while discounted returns are the highest.

Of course, in any model there are other factors that can affect this. Constraints imposed on models mean that stands are never uniformly managed to their economic rotation age. Furthermore, a model can be constrained to perform any amount of an activity (within the limits of solving feasibility) even if those treatments are not economically advantageous.

How to Choose the Discount Rate

As a first step, determine who the landowner or the beneficiaries of the forest are. In some cases, this is easy to do. In others, including public trust lands, it is a more involved task.

Once the identity of the landowner(s) or beneficiaries is found, ask them what discount rate they want you to use. If they can tell you what their preference is, go with that rate. Otherwise, consider if the land is publicly owned or privately. If the former, determine if the owner is truly the public at large or if there are specific public beneficiaries as is the case with public trust lands in the United States. If the public at large is the owner, we recommend that you use a social discount rate and follow government guidelines such as those of the United States Environmental Protection Agency’s (EPA). If there are public beneficiaries, such as local municipalities, check if the trust manager has a fiduciary obligation to maximize revenues for them. If there is no fiduciary obligation, consider using a social discount rate as discussed above and in agreement with the beneficiaries. Otherwise, the rest of the process is the same as with private landowners.

For private landowners who want to maximize revenues and for forestlands with a fiduciary mandate, the discount rate must be calculated as the sum of two components. The first component is the pure interest rate. The second are the premiums that account for the differential risks, taxes, liquidity, transaction costs and the length of the temporal horizon associated with the activity or plan.

The pure rate is the rate of return for an imaginary, perfectly liquid, risk-free, tax-free investment in a world with no inflation, no transaction costs and a very short time horizon. Since no such investments exist in the real world, one is left to choose one that comes closest to this ideal. Call this as the base rate. If the landowner or the beneficiaries must borrow money to fund the project, use the best rate at which they can borrow that money as the base rate.

If they can use their own money and wish to do so for the purpose of the project, use the rate of return they can expect from their best alternative investment (ARR) as the base rate. Next, consider the risk profile, the liquidity, the taxes, transaction costs and the length of the time horizon of the activity relative to that of the loan or the best alternative investment. If the activity under consideration has more risk, then you have to add a risk premium to the base rate. If it is less liquid, add a liquidity premium. If it is subject to more taxes, add a tax premium. Higher transaction costs and longer time horizons will require additional premiums. How much exactly should these premiums be? It depends. Perhaps, we will focus on pricing risk, liquidity and the other premiums in a future blog.

Lastly, it is very important to differentiate between real and nominal discount rates. The former does account for inflation, while the latter does not. The nominal rate is roughly equal to the sum of the real rate and the inflation rate. It is also the rate most often quoted by banks. As a rule of thumb, use nominal rates to discount future cashflows that are expressed in future dollars and use the real rate for those expressed in today’s dollars. We recommend for clarity that you adjust future cashflows for inflation (deflated) first. Then, discount these with the real rate (base rate plus premiums).